Candle 9: Dark Cloud Cover

That the Dark Cloud Cover occur after a strong uptrend and bearish conditions began to fill the market. Dark Cloud alert and protect the profits gained because in the short term prices will reverse direction.

Candle 10: Piercing, Signal Reversal Potential

If Dark Cloud Cover gives warning that the uptrend will end soon, otherwise the previous candlestick shows that the price will go down, otherwise Candle Piercing indicating that the downtrend will end / reverse direction, and conditions began to fill the market bullish.

Candle 11-12: Evening Star and Morning Star

Evening Star pattern typically occurs during a sustained uptrend. The existence of Star convey that the bullish and bearish pressure is attractive, but neither side wins. Then comes the third candle with a black real body, giving a strong signal that prices will reverse direction.

Next is a Morning Star candle. The Morning Star Formation candle is the opposite of the principle of the Evening Star which occurred during the downtrend begins with a black candle, then a third star and the candle into a complete reversal signal.

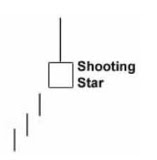

Candle 13: Shooting Star

Shooting Star Candle can only occur in a rising market potential. And now comes this candlestick would be a warning that the minor uptrend will experience a reversal. On Shooting Star is a small body and long upper shadow indicates that the bullish pressure is controlled by a bearish pressure.

Candle 14: Inverted Hammer

If we see the Inverted Hammer candlestick glance seem similar to the Shooting Star. The difference occurs at the end of the Shooting Star trending up, while the Inverted Hammer occurs after a significant decline took over.

No comments:

Post a Comment